November 2021

In the decades after independence, India's socialist ethos resulted in disastrous economic policies and inefficient capital allocation, leading to severe and persistent trade and fiscal deficits. In the three tumultuous years between 1989 and 1991, the disintegration of the Soviet bloc (then India's largest trading partner) and the oil shock arising from the Gulf War resulted in India being on the brink of default by July 1991. With barely two weeks of forex reserves, the Indian government was compelled to mortgage and airlift 67 tons of gold against a $2.2 billion emergency loan from the International Monetary Fund. The mighty Indian Rupee depreciated 74% against the US$ from Rs 17.94 in 1991, to Rs 31.22 by year-end 1992.

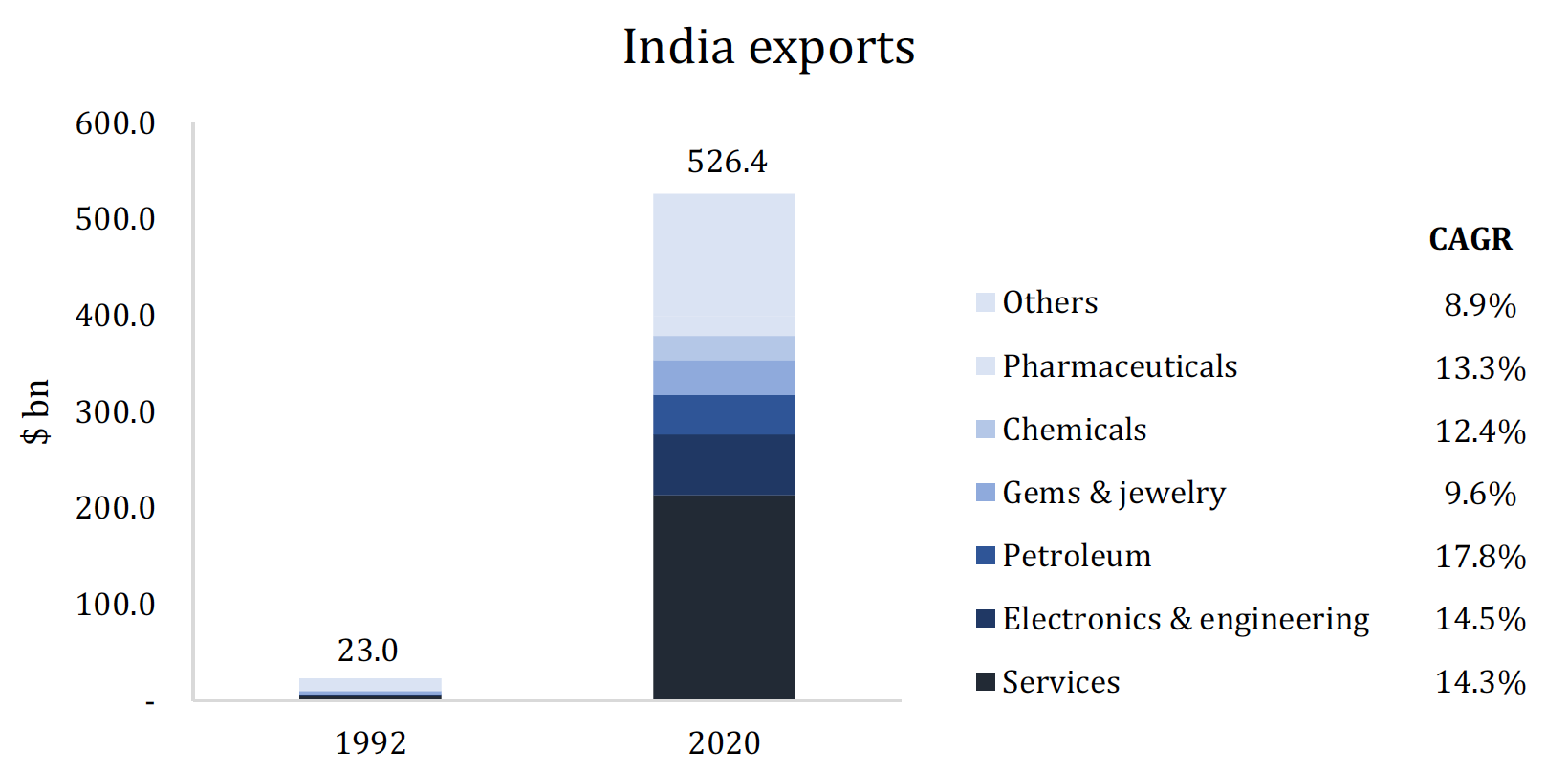

In 2021, India's $642 billion forex reserves are the world's fourth-largest, propelled by flourishing exports. In the intervening three decades, India's exports grew ~23x from $23 billion to $526 billion, compared with the growth in world trade of ~7x in the same period. The contribution of exports to India's GDP has increased from 3.5% in 1991 to an impressive 18.3%. It would appear that India has been leading globalization!

And it appears that India's best days are yet to come. Notwithstanding multiple national lockdowns amidst a global pandemic, export growth over the past nine months has been unprecedented. In the month of September 2021, India exported goods worth $33.4 billion, a 22% rise over September 2020 and a 29% jump over September 2019. Exports totaled $313 billion during April-September 2021 (with each month breaking previous records), up nearly 41% year-on-year and on track to reach the ~$600 billion milestone for the first time in India's history.

So steep has been the surge in Indian exports (exceeding imports by over 40%) that Maersk has had to reposition ~215,000 empty containers to India in the first eight months of 2021 to cater to unyielding demand. India's entire container volumes were 12 million units in 2016 and will likely end this year at 20 million, a lofty 66% growth in a mere five years. Since containerization is a critical component of modern logistics, this also reflects positively on India's improving efficiency levels.

All of this begs the obvious questions: What is fueling India's export engines and is it sustainable?

We believe the current export surge can be attributed to three key factors:

The third factor, China, has been a windfall that couldn't have been better timed. Restrictive environmental regulations, ongoing power outages, COVID-19 supply chain disruptions, fears about the likes of Evergrande and crackdowns on tech conglomerates including Alibaba and Tencent have left a bitter aftertaste for those companies that relied on China entirely, leaving them scrambling for a safety net. Countries such as Japan are actively incentivizing companies to move production out of China to other Asian countries (including India).

A fourth important factor contributing to India's export surge would have to be the introduction of a plethora of government incentives such as Production Linked Incentive (PLI) schemes. The PLI schemes aim to increase exports by bringing $520 billion of manufacturing to India over the next five years. These PLI schemes, a cornerstone of the government's push for achieving an 'Atmanirbhar Bharat' (literally meaning self-sufficient India), encourage domestic manufacturing for Indian and foreign companies through a $26 billion program that includes sales incentives, land and infrastructure support, and branding and product development support.

Tech giants such as Apple and Samsung have announced manufacturing investments exceeding $110 billion, which will result in increased electronic and engineering goods exports (currently at $57 billion or 10.8% of annual exports, and growing at 14.3% p.a. since 1992). Tesla is considering plans to move a significant part of its production from China to India. Further, the Government of India has announced an investment into a $7.5 billion chip factory to ease the current shortage plaguing the several industries ranging from 5G devices to electric cars.

Chemical and pharmaceutical products already contribute $50 billion to India's exports (9.5% of annual exports and growing at 13% since 1992). Due to the availability of know-how and the resources to build and operate FDA-approved factories, India is the top destination for vaccine and other generic pharmaceutical production. India is not only vaccinating the world, but also fast becoming its pharmacy. Somewhat critically, Indian chemical and pharma manufacturers are aggressively backward integrating, permanently eliminating any reliance on Chinese bulk commodity chemicals as inputs into their supply chains.

The rise of a 'homebody' economy, in which people staying home are spending on their comfort zones, has resulted in a surge in textiles exports. Continuing demand post an initial spike suggests that this is sustainable rather than a one-off. Indian textiles, which already command a 50% share of the US home textiles market, are poised for additional growth.

India's long-awaited transformation into an export powerhouse is no longer a dream. Assuming a zero-sum game, a mere 10% shift of China's 242 million container-loads of export volume in favor of India would more than double India's 20 million container-load!