May 2021

In our view, the debate on inflation has been settled. It is upon us with ferocity. The critical next question: will we experience stagflation or reflation?

The term stagflation was coined in 1970 by Alistair McLeod, then UK's Chancellor of the Exchequer, to describe the economic environment at the time. Inflation was accompanied by stagnant economic growth and hence resulted in a debilitating erosion in spending power and thus wealth. We are doubtful that Rishi Sunak, the current Indian-origin Chancellor, would aspire to preside over only the second recurrence in half a century. However, if global economic growth does not sustain through 2021, the risk of stagflation is perceptible.

In contrast, some of the world's largest asset managers are currently backing the reflation trade, a wager that inflation will be accompanied by sustained economic growth, far outstripping pre-pandemic activity levels. Such reflation trades tend to be riskier in nature, betting heavily on companies that may not have the ability to hold pricing power or pass on costs, amid an environment of rising earnings multiples. In our view, the explosion of SPACs and the aggression of Robinhood investors are telling signs of animal spirits at work.

In 2020, the great policy debate tended to be around the trade-off between today's health and tomorrow's wealth. By and large, affluent nations were able to prioritize today's health by harder and prolonged lockdowns and travel restrictions while softening short-term effects via stimulus packages and accelerated vaccine rollouts for their citizenry. During the year, global money supply increased by 17.3% or $14 trillion, with the US Fed alone injecting more than $120 billion each month of the year through bond purchases.

Less affluent nations were hard pressed to incur these economic costs and hence signalled early that lives and livelihood should return to normalcy. For much of 2020, India seemed relatively less affected and hence well positioned to achieve the dual objectives of today's health as well as tomorrow's wealth. The second wave currently ravaging India, though, may lead to a different picture in the months to come.

The Indian government tried to protect the country's financial position by remaining tight fisted on stimulus packages - to protect the currency from sharp devaluations and maintain India's sovereign rating at investment grade. Notwithstanding, sufficient damage was caused. A 2021 study by the Pew Research Centre (in collaboration with the World Bank) estimates that the number of people living below the poverty line (i.e., earning less than $2 per day) doubled to 134 million due to the pandemic and resultant loss of incomes.

Many less affluent nations have found themselves caught between the proverbial rock and a hard place. Given the globalized nature of capital flows, inflation generated by the rich nations flows everywhere. The triumphant bravado of heavyweight champion Joe Louis comes to mind: "you can run, but you can’t hide."

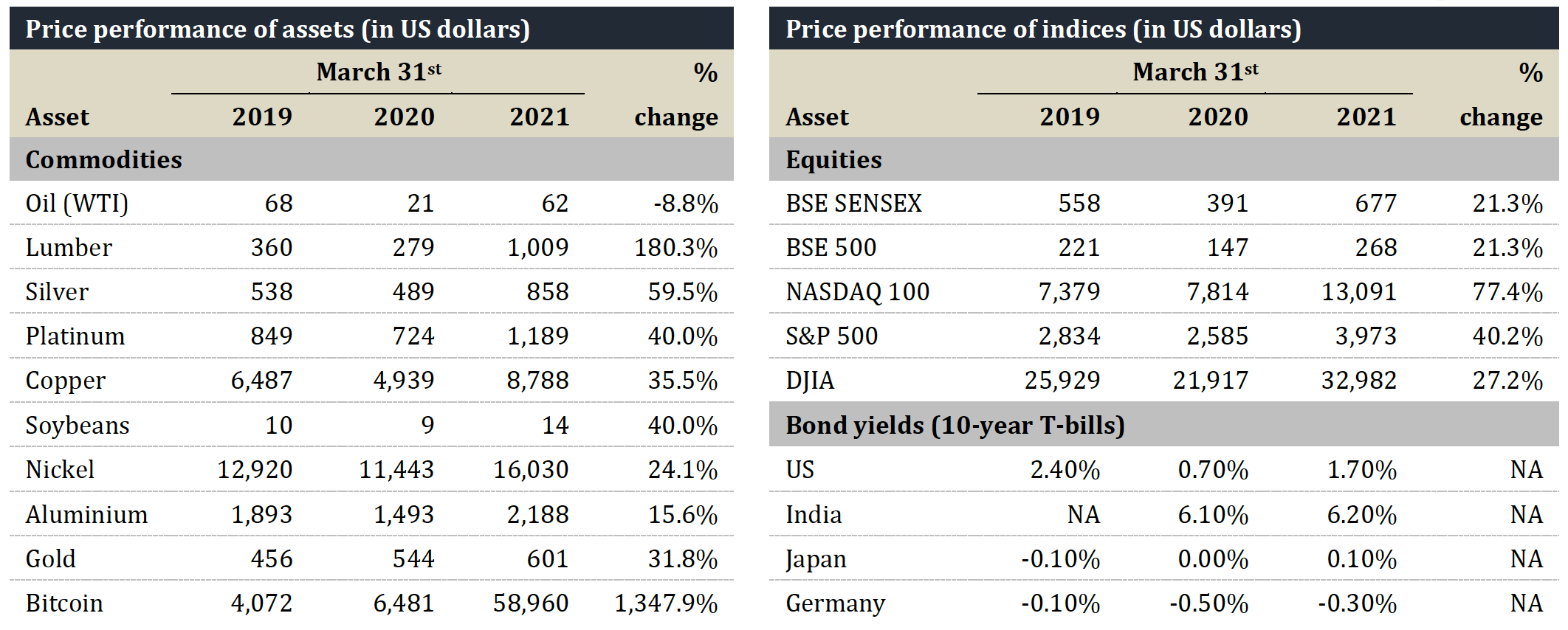

The increase in money supply has resulted in an escalation of prices across almost all asset classes, including equities, fixed income, real estate, commodities, and even the up-and-coming cryptocurrencies. Freight rates have seen a prodigious rise, with popular routes seeing 2x-3x price increases while some routes are even up 10x over the past two years. Containers are in short supply globally, in great part because of the enormous cost of repatriating "empties" back to exporter nations while changing supply chains away from China exacerbate the situation.

Of various global and local factors affecting a country's economy, there is one that perhaps has the most profound impact on trade and payments – oil. Crude prices witnessed the largest-ever drop during the pandemic, with some futures briefly going negative. At $43/barrel in March 2019, oil futures dropped briefly to negative $38 in March 2020. How ironic that one could be paid to own oil when OPEC+ had cut production to increase prices just weeks before!

Not surprisingly, oil remains one of the few commodities which has not yet seen a proportionate inflationary rise when compared to equities, bonds, and other commodities – partly due to the moribund travel sector. We believe that, as inoculation programs reach critical mass, air travel will surge fueled by 'revenge tourism'. Subject to OPEC+ maintaining production discipline and political compulsions not leading to irrational economic choices, a significant increase in oil prices might be on the cards.

India imports more than 80% of its domestic oil consumption, leading to an import bill of approximately $120 billion in 2019 (~5% of GDP). Any increase in oil prices will adversely impact the country's balance of payments and lead to a wider current account deficit. Based on a recent estimate, India's deficit would increase by ~$12.5 billion (~0.4% of GDP) for every $10 increase in oil prices. Additionally, the increased outflow of dollars would impact India's foreign currency reserves and hence weaken the Rupee. The Indian equity markets have remained buoyant over the past year since the pandemic commenced (the BSE 500 was up 76.6% in the year to 31 March 2021), mirroring other markets. However, an increase in oil prices may well impact Indian equities more than others.

One of our investing heroes, Warren Buffett, famously said:

We subscribe to Warren's approach and spend minimal time attempting to answer lofty questions about the macro. However, as we look for undervalued securities, we believe it is critical to differentiate cigar butts from hidden gems; both are undeniably affected by global events. Consequently, we recognize an inherent macro bet embedded in the portfolio (e.g. for or against the Rupee, international trade, inflation/reflation bets). We endeavour to improve our assessment of risk by keeping an eye on our exposure to macro trends while maintaining a primary focus on fundamental company analysis.

Back to Insights