Perspectives

MAGA vs MIGA: will political interests position the two nations as friends or foes?

February 2025

- Donald Trump, sharing the stage with Modi, in Houston, 2019

Donald Trump has been dogged in his agenda to "Make America Great Again" (MAGA). Similarly, Narendra Modi's vision of "Sab ka Saath, Sab ka Vikas" (meaning "Together for everyone's prosperity") equates to "Make India Great Again" (MIGA) aligning the two nations in similarly self-serving goals to enrich their respective nations at all costs.

Both leaders share one undeniable trait – you may love them or hate them, but you can't ignore them. While Trump's fans may venerate him like Nation Builder Thomas Jefferson, his critics are more likely to despise him like Bunga Bunga Berlusconi for all his flaws, brazenness and private sector interests. Similarly, Modi's supporters may revere him akin to Father of the Nation Lee Kuan Yew, whereas his detractors would likely moniker him as Stalin the Narcissist who famously renamed cities and stadiums in his likeliness.

One can easily visualize a Trump tirade: "Let me tell you, we're bringing the toughest tariffs you've ever seen on China—nobody's tougher on China than me. It's all about America first—our oil, our tech, our defence, everything American, the best in the world. These policies are huge—and they're going to Make America Great Again!"

Trump's agenda is bound to influence India's economy but how? Will Modi react to the coming geopolitical storms with terms of endearment or bluster? MAGA vs MIGA could possibly result in an alignment of interests or an ugly collision course… which one is it?

Is China too big to fail?

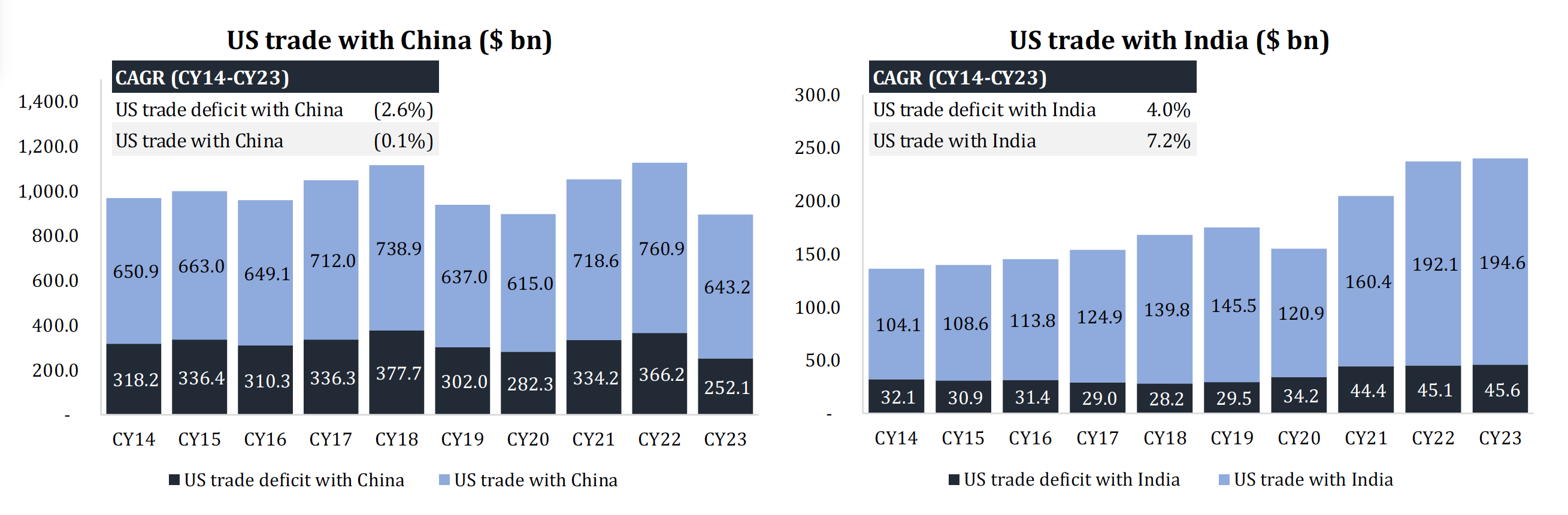

China+1 sounds good but can Trump actually implement this? In 2023, the USA imported worth $447.7 billion from China (11.6% of imports) vs 13.7% from Mexico and 12.5% from Canada. However, the USA's massive $252.1 billion trade deficit with China is 32.1% of the nation's overall, whereas Mexico and Canada account for 20.7% and 5.2% of the trade deficit respectively. In contrast India exported to the USA worth a paltry $120.1 billion generating a meagre $45.6 billion trade surplus for India (ie: 5.8% of the USA's deficit).

Since Trump's first inauguration till 2023, USA's imports from China have grown at a moribund -2.6% whereas India's exports to the USA have grown at an impressive 7.7% annual clip. Given a businessman's focus on P&L (ie: trade deficits), it's not hard to see why and where Mr Trump will continue to focus his vitriol and policies.

As India has modernized, it has emerged as a significant exporter of items like PV modules & electronics, and is working on initiatives in further value added items like semiconductors. While India is deftly and cleverly positioning itself as a reliable and trustworthy alternative to China, this only works while India remains too small to matter.

India will need to strike a delicate balance—expanding trade with the U.S. while safeguarding its economy from the potential influx of surplus Chinese goods, a likely consequence of stringent tariffs.

Drill, baby, drill: US oil to turbocharge India's economic engine

The inflationary effect of tariffs can be neutered by muted oil prices, something in Trump's control. He plans to massively ramp up US production and encourage others to do so.

Currently, India imports 85% of its oil and demand is projected to grow by 8 million barrels per day by 2050, which equates to 45% of incremental growth in global demand. A price reduction of just $10 per barrel would reduce the oil import bill by $17 billion leading to a reduction in our Current Account Deficit by 0.5% (from the current 0.7% of GDP).

Reduced oil prices will inevitably ease inflationary pressures and help reduce the depreciation impact on the Rupee from the 3.4% over the past decade to perhaps ~2.5% going forward. Furthermore, while GDP grew at 9.8% between FY18 and FY 23, corporate earnings of the NSE500 grew at an impressive 17.6% CAGR. One can visualize a similar corporate outperformance as oil prices continue to soften.

Navigating Trump's "America first" demands

With his characteristic friend vs foe mentality, Donald Trump is likely to expect trade partners to prioritize American products. This could pose a diplomatic challenge for India given the country's historical ties with Russia for oil and defence supplies.

However, in the current geopolitical climate, India remains nervous about it's aged military, with tensions visible on numerous borders – notably Pakistan, Bangladesh and China. India's antiquated Russian equipment can no longer be replaced or "band-aided" after decades of disrepair. Given India's shared objective with the U.S. of countering China's growing assertiveness along its borders, and Trump's exhortations that India buy more American-made weapons, this could pave the way for heightened activity from major American defence firms like Lockheed Martin, General Dynamics, and Northrop Grumman. India's defence offset program also suits Trump who needs friendly partners to help supply his defence contractors.

Our predictions

Trump's MAGA agenda could ultimately have net positive outcomes for India if it plays the diplomacy card well. Some of our predictions for India at the end of Trump's tenure:

Notes:

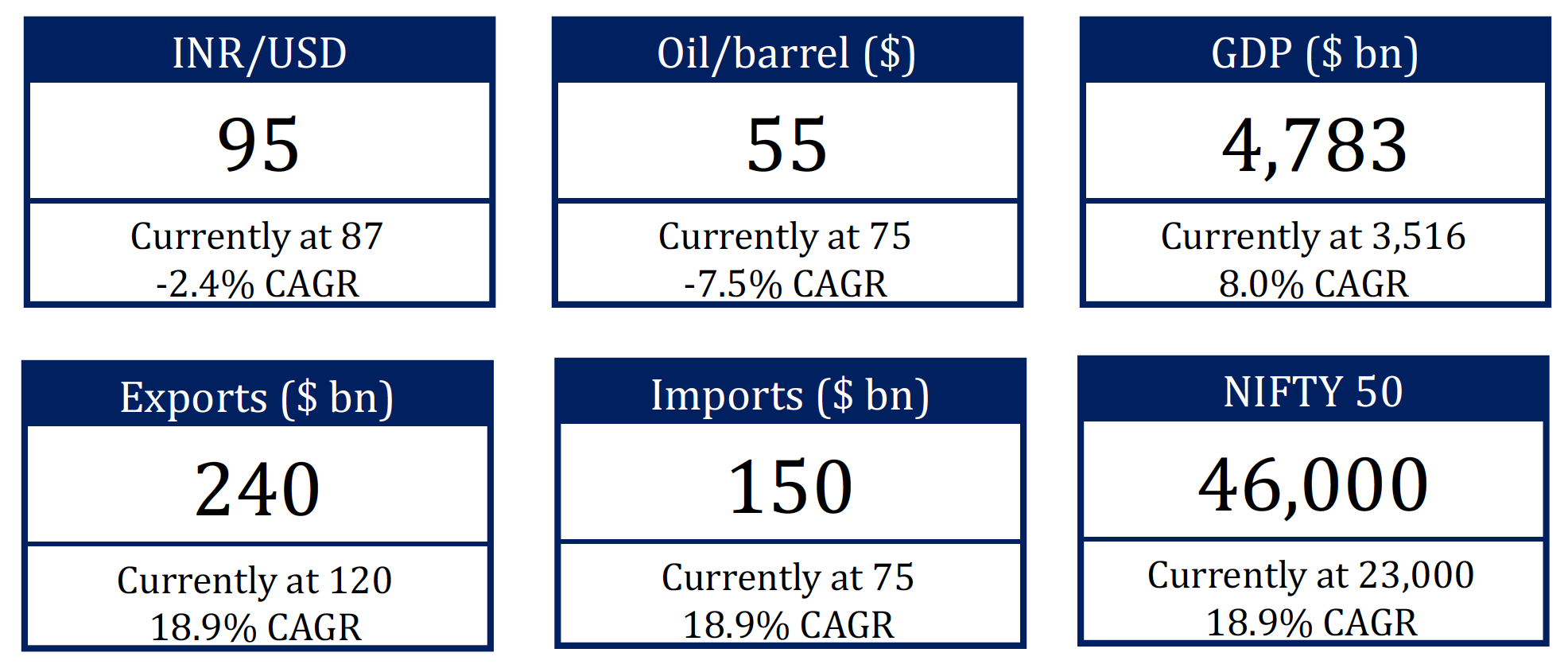

- The USD/INR exchange rate will reach 95, marking a depreciation rate of 2.4%, compared to 3.4% over the past decade. While lower oil prices will pump up India's foreign reserves, giving the rupee some muscle, the Indian government will likely keep it on a diet – a weaker rupee means Indian exports stay competitive in the global market.

- Oil prices will decline from $75 per barrel to $55 per barrel, courtesy of increased production. Trump has already called upon Saudi Arabia to lower oil prices, arguing that cheap oil = world peace, Ukraine conflict included.

- Nominal GDP growth is projected at 8%, propelled by increasing exports and lower production costs thanks to falling oil prices.

- India's exports to the US will rise from $120.1 bn in 2023 to $250 bn powered by the China +1 strategy and Indian policymakers' efforts to maintain a weaker rupee. The estimated CAGR of 20.0% compares to a rate of 15.7% for the period of 2020-2023, and 6.5% over the last 10 years. Even if global trade remains constant, now is the opportunity for India to get a larger slice of it.

- India's imports from the US will increase from $75 bn in 2023 to $150 bn in 2029.

We expect the Nifty index to double from 23,000 to 46,000 by the end of Trump's tenure, driven by earnings growth and Price-to-Earnings (P/E) multiples remaining constant at current levels of 21.79x

Back to Perspectives