May 2023

For those uninitiated to The Eagles' magnum opus, the 'Hotel California's lyrics speak of the protagonist's sojourn at the eponymous hotel. While inviting from a distance, it is, in fact, a trap nobody can escape from, notwithstanding the ability to 'check out'. The hotel, as the song goes, is only programmed to receive guests; leaving is not an option.

Viewed from a distance, India's stock markets are an attractive place to be. The benchmark Sensex has grown by 12.4% annually over the past 20 years (in USD terms), a figure 1.7x the Dow Jones Industrial Average (7.1%) and 2.4x that of the Shanghai Composite index (5.1%). Almost universally, the top 200 stocks have created enormous shareholder wealth and are instrumental to the fortunes of India's ~150 billionaires.

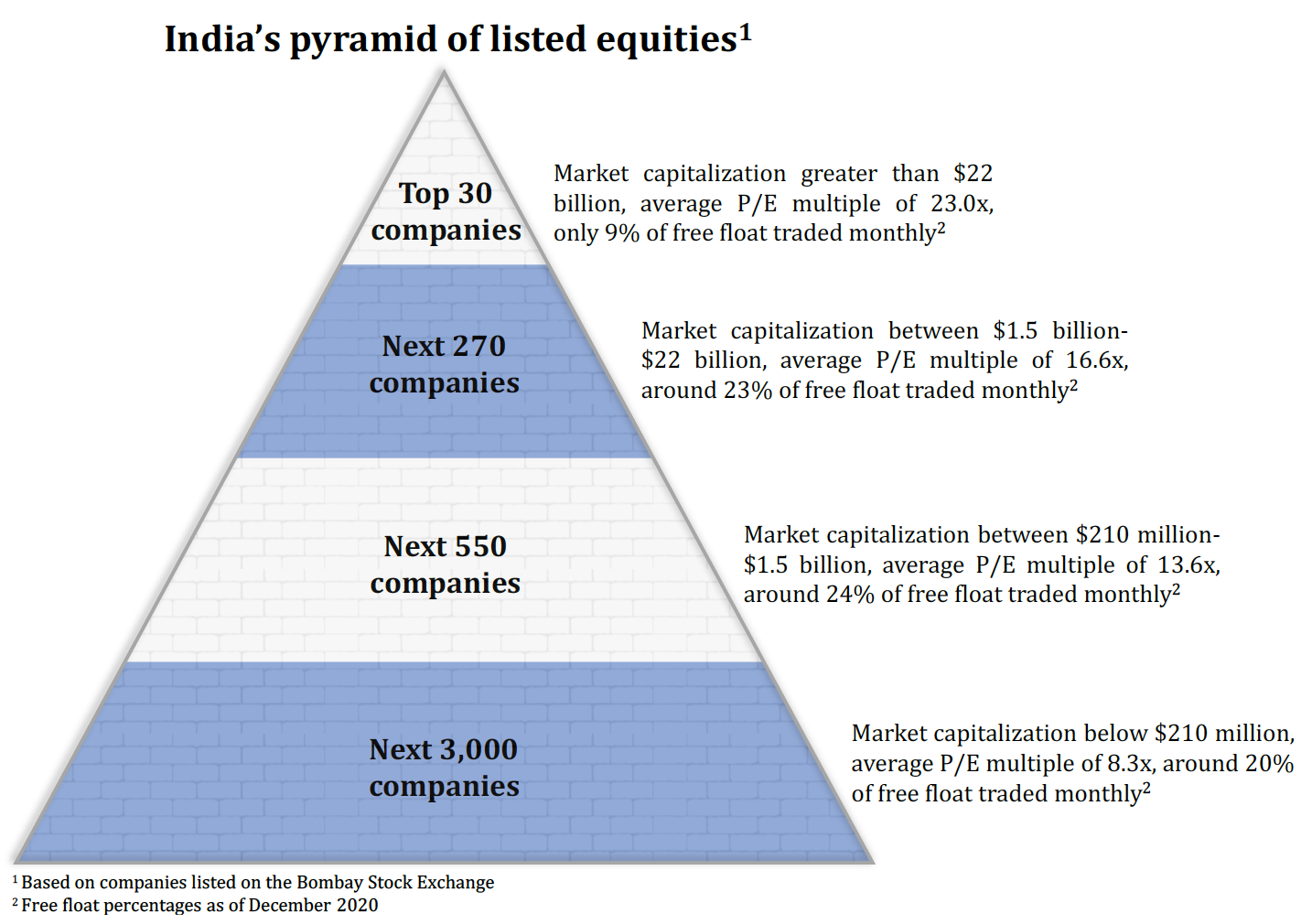

Yet, the top 200 companies represent less than 3% of companies listed across all exchanges. Research coverage of these large companies is generally comprehensive, and their trading activity comprises around 48% of total volumes. When one looks at the cream of the crop, all is well with India's markets. But what of the remaining 6,000-plus companies?

For the smaller, uncovered and less liquid companies, The Eagles' lyrics are poignantly apt. Two factors constrain or inhibit these companies from leaving India's exchanges: the first is the complexity of de-listing (i.e., taking private) in case management ("promoters") wish to do so. The second, in case cynics do not believe the company is worthy, is the inability to short-sell mispriced companies. This inability to short creates a positive and upward bias allowing unworthy companies to remain listed, sometimes for decades past their due date.

The net result, depending on one's perspective, is either a wasteland of irrelevant listed companies where minority investors can't leave or a dreamland of poorly understood and mispriced companies, a capitalist's feast.

The eternal lock-in period

Investors in mature markets routinely unlock value by taking inefficiently priced companies private (often financing the purchase with debt) and then restructuring the business without public scrutiny.

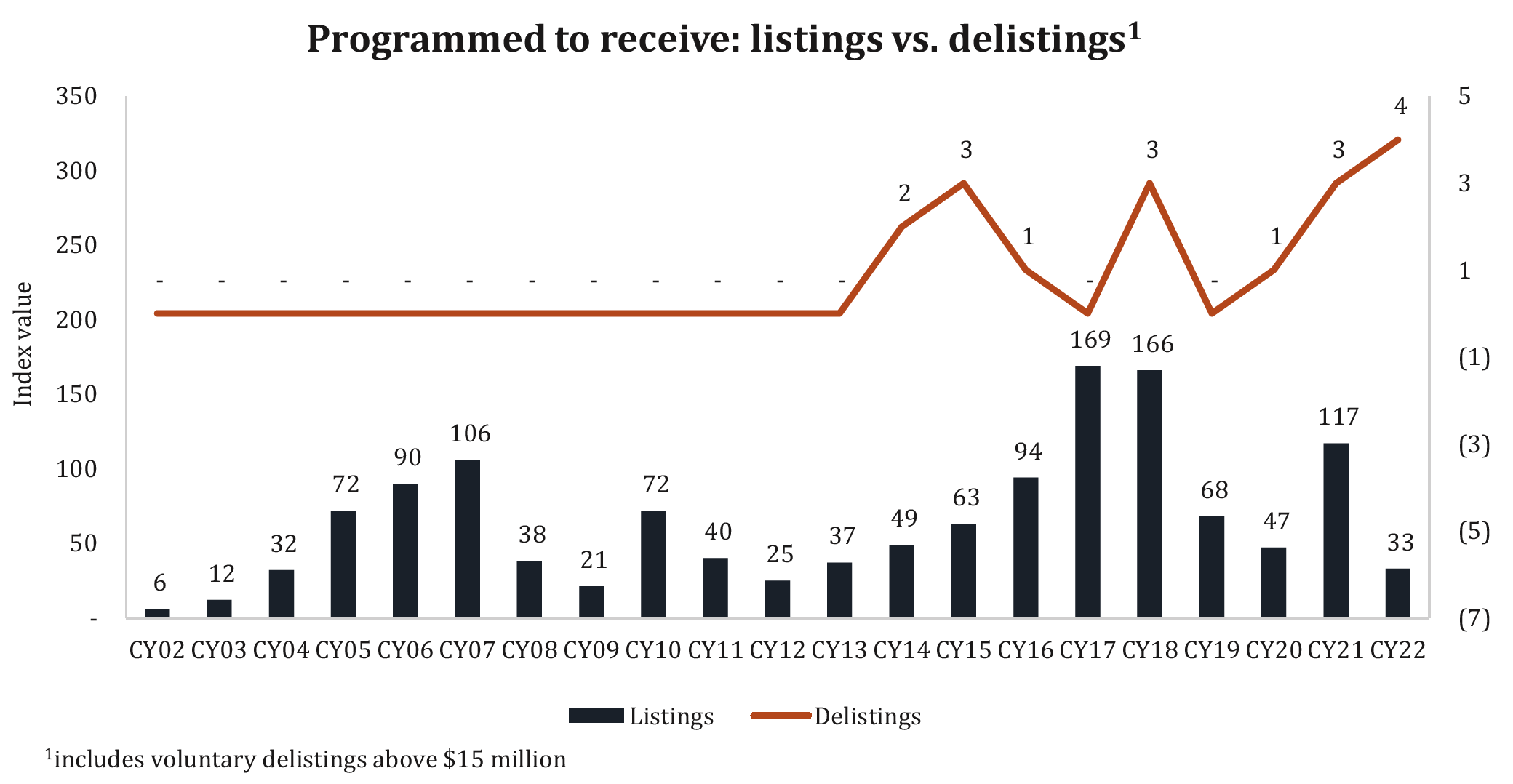

Indian regulations, however, make delisting a process akin to skipping while running a long hurdle race: technically possible, but lengthy, complex, and prone to much tripping. The result: in the last 20 years, over 1,350 companies have listed on India's exchanges, but only 17 have been able to delist voluntarily.

To delist, the acquirer must solicit each shareholder who can declare their desired price, a process known as the reverse book-build. With funds required to be escrowed for several years as surety and without certainty of a deal or clarity on a clearing price, only a few highly motivated acquirors have even attempted this process. In one of the only private equity-backed delistings, IT services company Hexaware Technologies was delisted by Barings Asia at ~INR 475 per share – a premium of ~79.0% over the price when they announced the delisting offer!

The pain of the delisting process does not end there. Even once shares repurchased cross the 90% delisting threshold, acquirers must maintain funds in escrow for another year to pay the remaining 10% if those shareholders later decide to tender their holdings. In the interest of shareholder protection, minority investors are given free option value and the power to demand extortionate prices.

The daunting complexity of the delisting process means an eternal lock-in for listed companies. Unlike other markets, the costs of staying public are not significant. Scrutiny levels for smaller companies are low, given the lack of analyst coverage and limited scope for activism. So long as a company has the minimal cash balances necessary to remain solvent, they can stay checked in for decades and do not have an option or need to leave.

Coming up short on shorts

For those listed companies withering on the vine, short sellers can play a constructive role in letting true value be reflected. In case fortunes have been adversely impacted for any reason – business failures, weak corporate governance, or worse, true value may not be correctly stated due to lack of selling and shorting pressure. If such companies are overvalued, they may not be able to raise fresh capital while overstaying their welcome in what is clearly a cluttered listed universe. Here too, regulations have found a way to tie the exit process into knots.

Short selling involves selling shares one does not own to exploit the mismatch between market price and intrinsic value. Determining this intrinsic value is where 'shorts' differentiate themselves: they introduce an element of sanity to overvalued markets where a buy-only bias prevails. In the US, it is estimated that short sellers netted over $300 billion in profits in 2022; that same year, the S&P 500 lost ~$8 trillion in market capitalization.

Indian regulations prohibit short selling while allowing Futures and Options (F&O) for a select list of larger companies. However, this method only allows speculators to use short-dated call and put options to bet on the movement in stock prices rather than betting for (or against) the stock itself. As the behavior of oil futures during the Covid-19 pandemic showed, derivative instruments can move independently of the assets they track.

The second hurdle is time – using F&Os means investors can maintain a contract for just three months. Given that sometimes it can take years for an opposing view to pay off, these short-fuse time restrictions make short selling feel more like day trading than an actual value discovery exercise.

The inability to truly express a negative view via a short position results in a paradise for long-only buyers, contributing to the premium valuations commanded by the Indian markets. Over the last 10 years, the Sensex has traded at an average P/E multiple of 17.8x (it currently trades at 23.0x), compared with a 16.6x average for the Dow Jones Industrial Average, a 13.1x for Germany's DAX, and a 10.8x for Hong Kong's Hang Seng Index.

Another brick in the wall

The pyramid of listed equities reveals some interesting dynamics about the Indian capital markets. The larger companies clearly trade at premium valuations, on average, which is to be expected given their scale as well as prominence in the public eye. However, it may surprise some that the liquidity profile for smaller companies remains higher – hovering around 20-24% of free float traded monthly. These are, of course, averages and there are specific stocks that exhibit aberrant behavior.

Information and pricing inefficiencies combined with limited flexibility to short or exit – these are exactly the characteristics applicable to private markets. The market opportunity is ripe for active, long-term investors to deploy patient capital and focus on building businesses brick by brick, thereby creating significant value over time.

Traditional global paradigms do not fit neatly within the context of the Indian capital markets. Globally, private equity fund managers focus on active management of private companies, while public equity managers passively invest into well-researched listed securities.

The Indian capital markets present a bounty of opportunities for investment managers willing to play an active role with poorly researched listed companies. Rather than focusing on quick exits, these investment managers can patiently build businesses and create extraordinary value.

Ben Graham's oft-repeated observation has never held truer than in India: "In the short run, the market is a voting machine, but in the long run, it is a weighing machine."