Perspectives

Valuations in India have soared to dizzying heights

November 2024

Those are the five euphoric points, and the first four, it's not an accident, they're all followed, not by the best economic times and best market returns. They are followed by the four worst economic setbacks and the four worst periods of stock market return. What a strange coincidence."

- Jeremy Grantham, October 2024

Of late, a lot of conversations have been focused on various versions of Grantham's

refrain. One can easily understand why. The Nifty 50 P/E is trading at a staggering 89%

premium to the MSCI EM index, well above its historical norm of 50%. Meanwhile, the BSE

Sensex is breaking records, having climbed every year since 2016. The MSCI India has

appreciated 21% this year alone, outpacing the S&P 500's 13% rise. MSCI India has

more than doubled since late 2019.

Then we have had a slew of brain-numbing IPOs in a hot market. Resourceful Automobiles,

for example, is a bike dealer with revenues of ~$2 million and net profit of ~$0.20

million. Despite their modest sized IPO of a mere $1.4 million on offer, they attracted

bids worth $570 million! Hence it is only natural for investors to wonder if there is

any sanity remaining in the IPO and broader stock markets.

Is there a bubble in the Indian stock market?

Definition: bubble, noun refers to a good or fortunate situation that is isolated from

reality or unlikely to last

At first glance, the Indian stock market may appear to be in bubble territory, but a

closer look reveals a far more nuanced market with structural factors explaining the

recent rally.

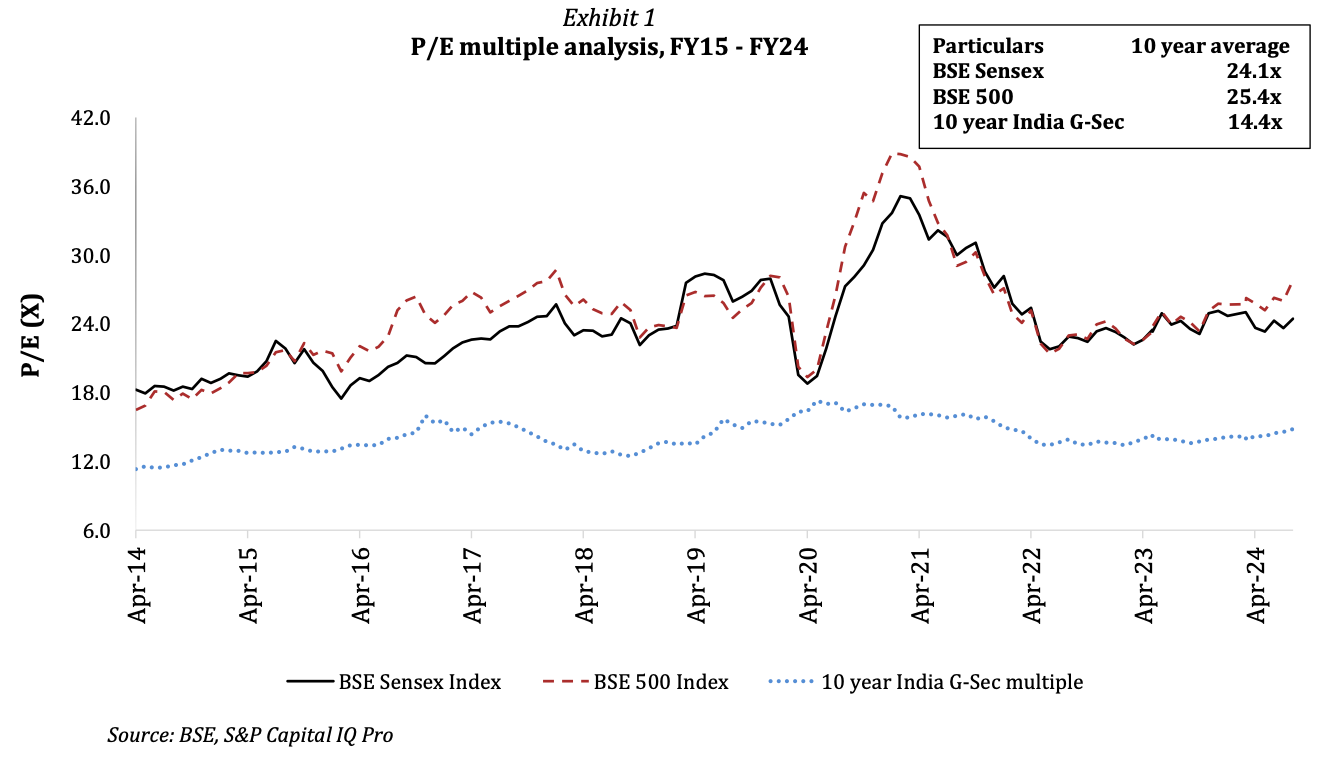

As of today, the BSE Sensex (top 30 stocks) currently trades at a P/E multiple of 23.8x

which is broadly in-line with the 3-year and 10-year averages which are both 24.1x.

Similarly, the BSE 500 currently trades at a P/E multiple of 26.8x which is only

slightly above the 3-year and 10-year averages of 24.6x and 25.4x respectively.

It becomes apparent that any run-up in the markets has been accompanied by commensurate

earnings growth. The corporate profit-to-GDP ratio has soared to its highest level since

2010, and earnings estimates for Indian markets have remained stable even as the S&P

500 and MSCI World Index falter. One hopes this continues!

Bubbles are typically fuelled by cheap debt, hot money, and/or excessive speculation.

While several examples, such as Resourceful Automobiles, certainly smack of excessive

speculation, the other two factors are not currently present in the Indian market.

A fundamentally changed demand-supply dynamic

All markets are a function of demand and supply. Even though the number of IPOs has been

increasing in recent years, the average over the last 10 years has been of less than 150

IPOs per year, in a market that counts close to 5500 mainboard listings and another

~1,000 smallboard ones. This gives a finite supply to domestic stock market investors,

whose demand for equity securities remains healthy for several reasons.

Most importantly, we have been in the midst of a monumental migration away from fixed

income securities. While these have continued to grow at 7.3% from 2019 to 2024, equity

flows have increased by 17.0% in the same period. Three main factors are fuelling this

transition:

- Interest rates on fixed deposits have come down from close to 9% ten years ago, to less than 6% today

- Based on the last two years' budgets, tax rates on certain categories of fixed income products have become punitive. While capital gains on listed equities are taxed at a rate of 12.5%, earnings from such fixed income products are taxed at the individual's marginal income tax rate which can go as high as 43%.

- A generational shift is also underway, as younger investors embrace equities. The median age of capital market investors has dropped from 38 years in 2018 to 32 years in 2024, with 40% being under 30 years of age. Reflecting this surge, the number of retail brokerage accounts has ballooned from fewer than 40 million in March 2014 to over 190 million in June 2024. It is staggering to think that more than 10% of the country's population has opened accounts in the past decade!

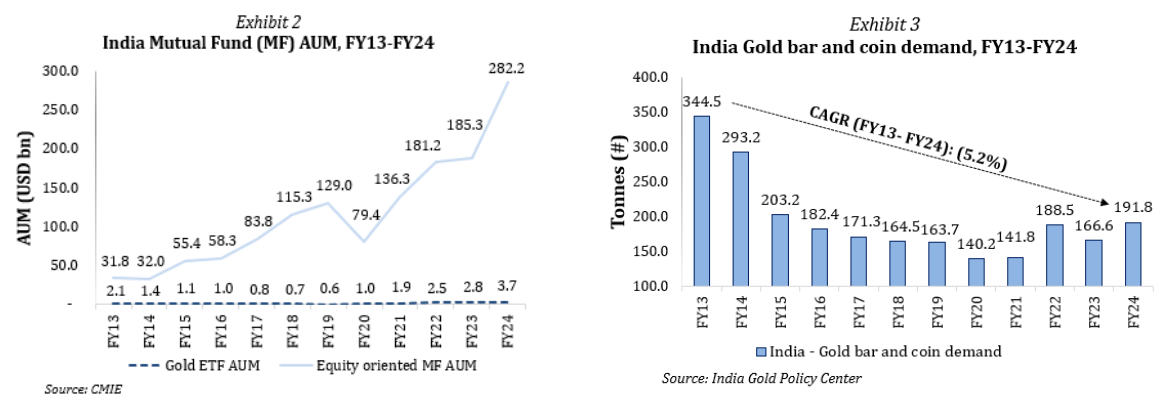

Additionally, Indian investors are no longer enamoured by gold and real estate, which

were the traditional investment options for decades. For instance, the demand for gold

ETFs grew at a compounded annual rate of 5.2%, increasing from $2.1 bn in 2013 to $3.7

bn in 2024. During the same period, the assets under management of mutual funds grew at

a rate of 22%, increasing from $31.8 billion to $282.2 billion. Demand for gold bars and

coins has also slowed, from 345 tons in 2013 to 192 tons in 2024.

The fact that Indian investors have shifted their demand in favour of equity has been

counterbalanced by foreign investors withdrawing huge amounts. Foreign ownership of

Indian equities has dropped from 25% in 2014 to the current level of 16% thereby

implying that the departure of foreign hot money is unlikely to pose a risk, especially

since Indians cannot invest their funds offshore due to capital controls.

The new normal

Strong economic fundamentals combined by interest and tax regimes that are unlikely to

adversely change, current valuation levels may well be the new normal. India recently

saw its largest IPO ever, that of Hyundai Motor India. Many other billion-dollar

listings like Swiggy and LG Electronics await their turn.

In the end, waiting for a market correction in a flourishing market would be like

waiting for the perfect weather to go on a picnic—you might just end up sitting at home

forever. Sometimes, you just have to pack your basket and jump in. As Benjamin Graham is

known to have said, "Successful investing is about managing risk, not avoiding it."